On 5 May 2025, Global Fund Advocates Network Asia-Pacific (GFAN AP), Joep Lange Institute (JLI), Malaysian AIDS Council (MAC), Malaysian AIDS Foundation (MAF), and the Center for Indonesia’s Strategic Development Initiatives (CISDI) jointly hosted the first webinar from a new series focused on innovative financing titled “Breaking Down Innovative Financing Tools: The Good, The Bad & The Ugly”.

This brand-new webinar series aims to build understanding of innovative financing by providing participants with a clear and accessible explanation of what innovative financing is, how it differs from traditional health financing mechanisms, and why it is relevant in the context of global health, particularly in the Asia-Pacific region. It also aims to showcase practical applications and lessons learned by highlighting real-world examples of innovative financing mechanisms, such as social impact bonds, health taxes, blended finance, and social contracting in the Asia-Pacific region, demonstrating their potential to address health financing challenges and improve health outcomes, while also discussing key lessons and challenges.

This first introductory webinar was attended by approximately 70 participants from Asia Pacific, Africa, North America, and Europe and was moderated by Jennifer Ho (Operations and Programmes Manager, GFAN AP). Dr Christoph Benn (Director for Global Health Diplomacy, JLI) was invited as a key presenter to provide an overview and introduction to innovative financing tools.

1. Welcome Remarks & Setting the Scene | GFAN AP, MAC & MAF, CISDI

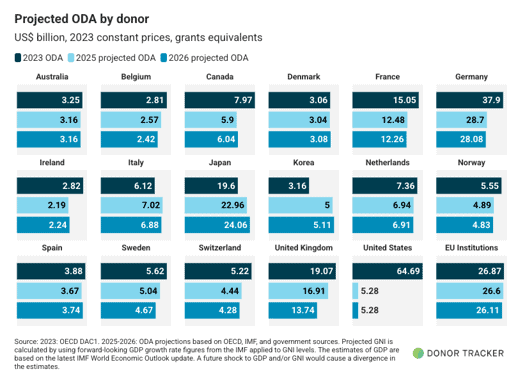

The webinar commenced with brief welcome remarks from the co-organisers, represented by Jennifer Ho (GFAN AP), Chung Han Yang (Deputy Executive Director, MAC), and Diah Saminarsih (CEO, CISDI). Next, Rachel Ong (Regional Coordinator, GFAN AP) provided contextualisation to set the scene for the webinar discussion, noting the importance of exploring innovative financing mechanisms to complement domestic resource mobilisation efforts by Asia-Pacific partners, particularly given current uncertainties around official development assistance (ODA) in the funding landscape. The floor was passed to Christoph for his presentation.

2. Innovative Financing Unpacked: A Practical Overview | Dr. Christoph Benn (JLI)

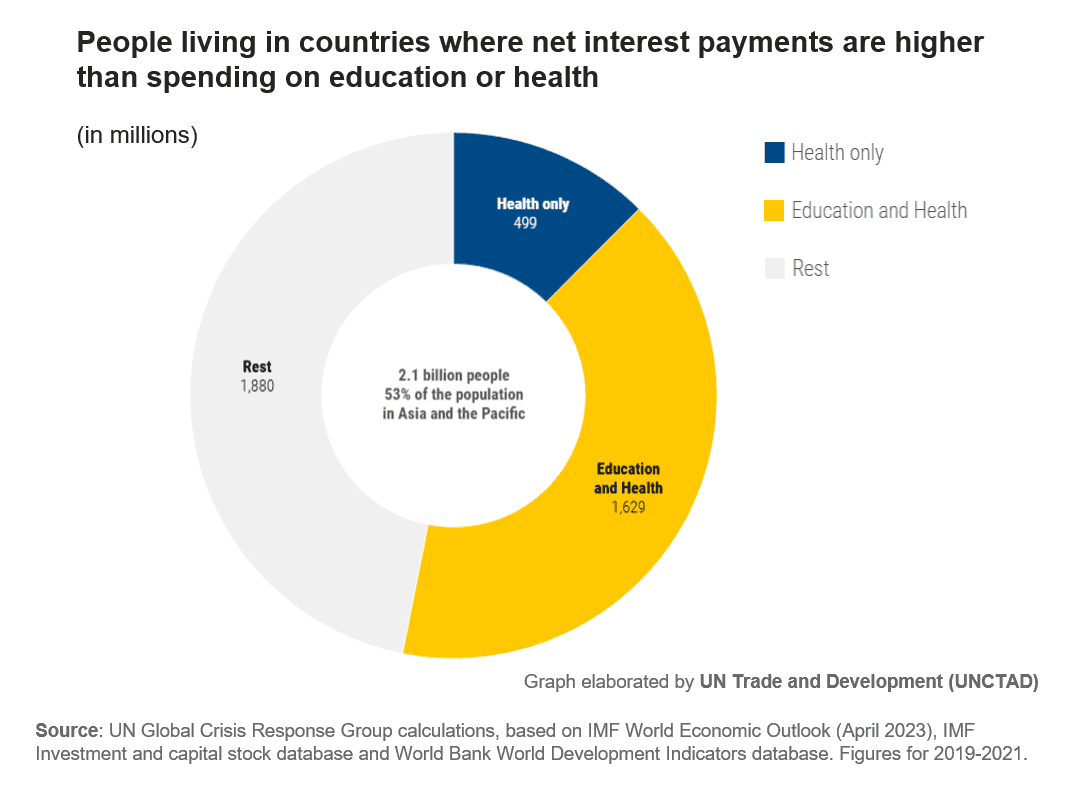

Christoph Benn began by acknowledging that we are at a critical juncture in global health financing, characterised by a “perfect storm” of challenges, with major traditional donors reducing their contributions to global health programmes. Even as global crises and challenges, often caused by climate change and conflict, are on the rise, public capacity to invest is severely constrained, with many governments’ budgets stretched and an increasing number experiencing debt distress. As a result, international aid is declining despite the growing need of investment. Additionally, in many low and middle-income countries, government spending in higher on debt repayment than investments in health and education. This has created a significant funding gap even as the need for robust health systems is more critical than ever.

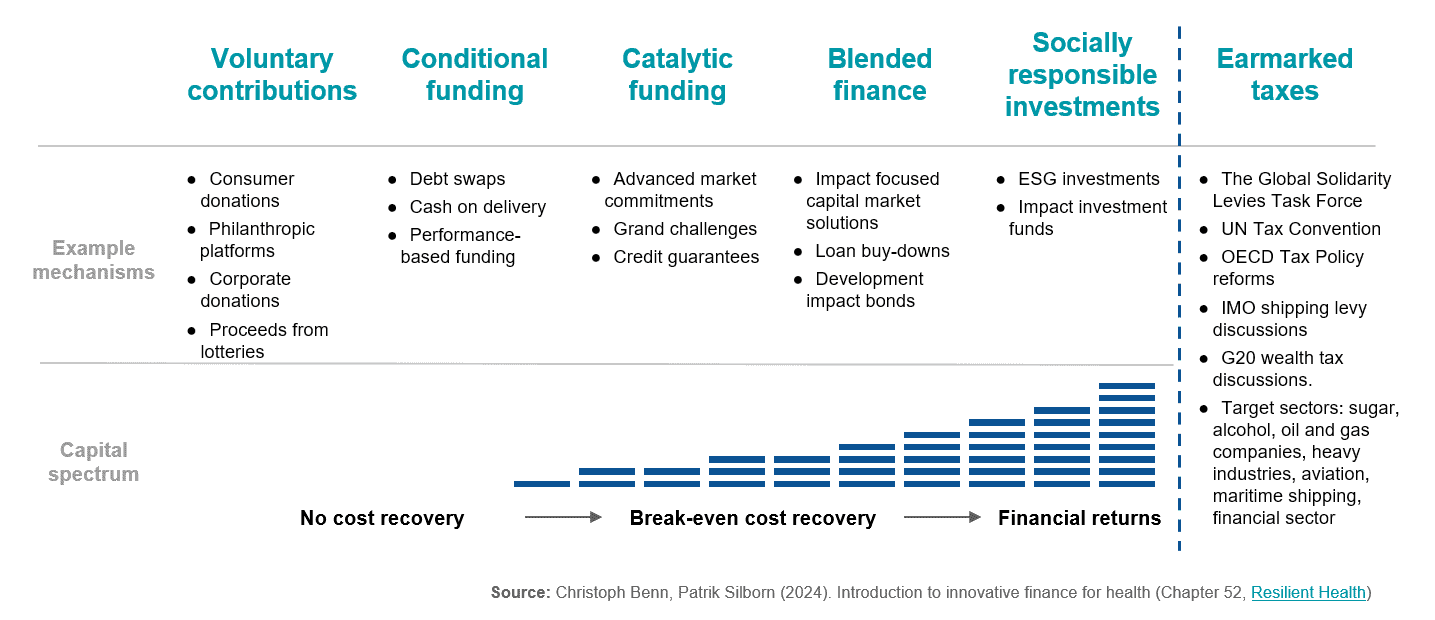

As traditional funding models are increasingly unable to meet the growing demands of critical sectors like global health, innovative financing is a complementary approach to unlock capital, leverage private sector investments, and drive long-term health outcomes. At the same time, it is important to have a realistic understanding of what innovative finance can and cannot do. Key to this is understanding the spectrum of mechanisms available, ranging from voluntary contributions which add net capital and resources to health programmes on one end, to investment instruments which come with expectations of financial returns on the other end.

Taxonomy of Innovative Financing Mechanisms

- Voluntary contributions are net additions of capital with no expectation of financial return. Examples include philanthropic donations and corporate initiatives like Product Red, which has contributed over $800 million to the Global Fund. While companies do not expect financial returns, they might expect to benefit in terms of branding and demonstrating impact to their customers and the public.

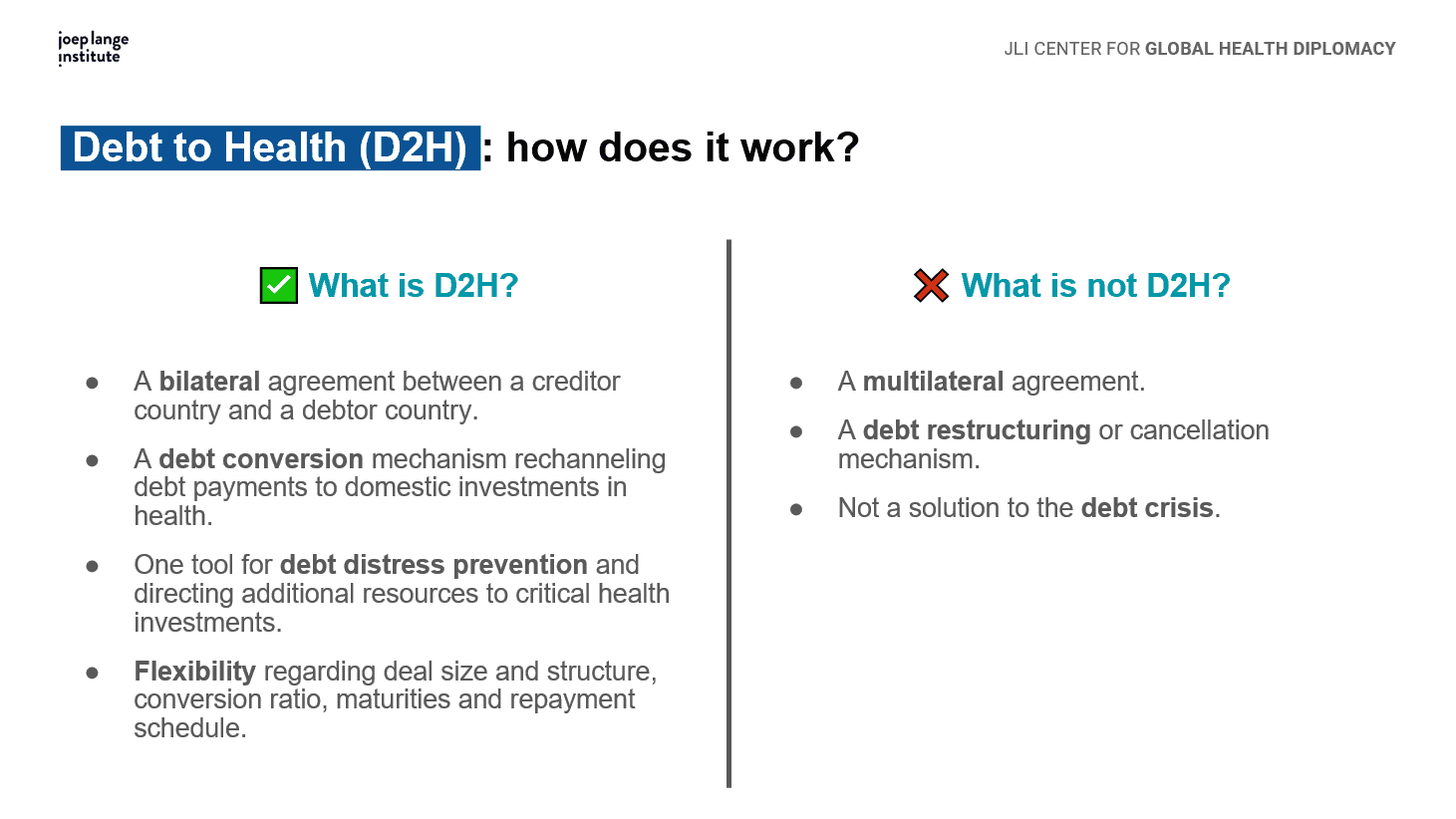

- Conditional funding also involves a net transfer of financing to a particular cause, but it would be contingent on certain conditions being met. A prime example is Debt to Health swaps, where a creditor nation forgoes a portion of a debtor nation’s debt in exchange for the debtor investing that amount into domestic health programmes. Other models include cash on delivery and performance-based funding where payment is conditional upon performance.

- Catalytic funding which includes advanced market commitments aims to incentivise innovations in product development, such as vaccines, by providing reassurance of economic return and product demand. This has been used effectively by Gavi, the Vaccine Alliance to encourage private investment in vaccine research and development.

- Blended finance combines grant funding with concessional loans, in a process often involving grant-making organisations and development banks. This enables loan buydowns where grant money is used to “buy down” or offset interest rates, thereby increasing the overall volume of available financing. Also in this category is the International Finance Facility for Immunisation (IFFIm), a mechanism which converts long-term donor pledges into immediate funding. Through IFFIm, Gavi uses pledges from public donor countries, such as the UK, Norway, Spain, and the Netherlands, as guarantees to raise ‘front-loaded’ funds from financial markets, which can then be immediately mobilised to fund vaccinations for children. Note, however, that which this mechanism is suitable for one-off costs such as vaccinations, it would not be practical for programmes with continuous and recurring costs.

- Socially responsible investments includes impact investment funds and social impact bonds which mobilise private sector capital with the expectation of both social and financial returns. These are generally more suitable for capital investments with a potential economic benefit, such as renewable energies.

- Earmarked taxes are levies which are specifically earmarked for certain purposes. A key example is the airline levy implemented by France in 2006 to fund organisations such as UNITAID and The Global Fund. This model is also practised by other countries such as the Republic of Korea. Other potential taxes under discussion include shipping levies on container transport to support climate organisations and “sin taxes” on certain items such as sugar, alcohol, and tobacco to increase government resources for health programmes, and so on.

Debt Swaps & Debt to Health (D2H)

Debt to Health (D2H) is a mechanism utilised by the Global Fund since 2006, in the form of a debt management proposition that combines debt reduction with an increase in domestic funding for health. Debt swaps are usually bilateral or trilateral agreements between a creditor and a debtor country, often facilitated by a third party like the Global Fund to ensure accountability.

In principle, debt swaps are very straightforward: the creditor cancels the debt and that is without any expectation of any further repayment, but with the expectation that the exact amount is invested in agreed health programmes in the debtor country. The use of the money is then guaranteed by a third party, such as the Global Fund, that provides the accountability and oversight over the use of the money.

To date, the Global Fund has conducted 14 D2H transactions, generating US$330 million in health funding for 11 debtor countries, and almost US$0.5 billion in debt canceled through D2H swaps since the programme began. Most recently in 2024, Germany concluded two D2H swaps, one with Indonesia worth €75 million and one with Mongolia on €30 million.

Debt swaps has been mentioned prominently in UN documents leading up to the Financing for Development Conference in end-June and early July, and has been a popular mechanism for other sectors such as climate, agriculture, nutrition, and nature as well.

A number of working groups are also currently looking into various forms of international levies, such as the Global Solidarity Levies Task Force, that are identifying and proposing options for implementing progressive levies to support climate and development action.

Christoph emphasised the importance of Global Public Investment, an approach to financing global public goods and global public benefits through continued, large-scale public investment. According to the Lancet Commission on Investing in Health, “greater international collective action is needed to generate (and finance) global public goods” such as antimicrobial resistance, pandemic prevention and preparedness, and access to new health technologies among the key areas that should be treated as global commons within the health sector.

Global cooperation and financing have been instrumental in achieving major milestones that today make our world healthier and more secure than ever before. According to a recent report by The Lancet Commission on Investing in Health, the world could reduce by 50% the probability of premature death (PPD) — dying before age 70 years — from the levels in 2019 by 2050. Christoph concluded his presentation with a reflection of the amazing progress that has been achieved over the last decades, and the potential good that is possible by strengthening global collaboration and financing for health.

Questions & Answers

Rafael García (Portfolio Manager, JLI) facilitated the Q&A session with participants.

Aslam (Peace Foundation Pakistan) asked about how a local or national-based organisation could access some of the innovative financing mechanisms that were presented. He also shared that disruptions to funding has made it difficult for organisations to respond to disaster and emergency situations.

Sonal Mehta (Vice-President, Projects, ECHO India) asked about which global organisations are frontrunners or early proponents of impact bonds, as based on her experience, some donors have expressed apprehension.

Christoph responded that impact bonds are usually implemented at the national level, with examples in India for the education sector. In other countries, impact bonds have also been used for malaria programmes. While it is an interesting model, the transaction costs can be considerable. Generally speaking, a number of innovative financing mechanisms work through international organisations such as Gavi, UNITAID, and the Global Fund, where the money is raised through the innovative finance mechanisms and then channeled through international organisations. In the Asia-Pacific context, philanthropic contributions could be an option for partners in countries such as Indonesia, Vietnam, and Thailand; whereas in India, the India Health Fund has been set up with support from the Global Fund. The Asia Pacific Leaders Malaria Alliance (APLMA) are also looking into debt swaps as a method to supplement funding for malaria programmes across the region.

Responding to questions in the chat box, Rafael provided more information around the upcoming Fourth Financing for Development Conference (FFD4) taking place in Seville, Spain from 30 June-3 July 2025, which takes place approximately once a decade. Much of the discussions will be around taxes, innovative financing tools, blended financing, and other mechanisms. JLI’s focus will be on anchoring discussions around debt swaps and the global public investment model, and to understand the contexts, incentives, and complexities in implementation for different countries and stakeholders. JLI is also submitting an application to conduct an official sideline event on debt swaps, and is looking to connect and share information with any civil society organisations who will be attending FFD4.

Responding to a question from Salomé Meyer in the chat box regarding integrated funding mechanisms and the often siloed nature of funds, Christoph shared that funds, whether large or small, are not innovative financing mechanisms in themselves and will still require financing. Christoph affirmed the urgency of an integrated approach to health financing that is based on the health needs of populations, particularly in low income countries, and rooted in principles of primary health care and universal health coverage.

3. Closing

The webinar concluded with closing remarks from Rachel on behalf of the co-organisers, thanking participants for their active interest in the topic. Rachel also re-emphasised the importance of community and civil society engagement in innovative financing processes, as well as communities’ roles in domestic resource mobilisation efforts and ensuring accountability at the country level.

SPEAKER:

PRESENTATION:

-

- Innovative Financing Unpacked: A Practical Overview. Presenter: Dr Christoph Benn, Joep Lange Institute.